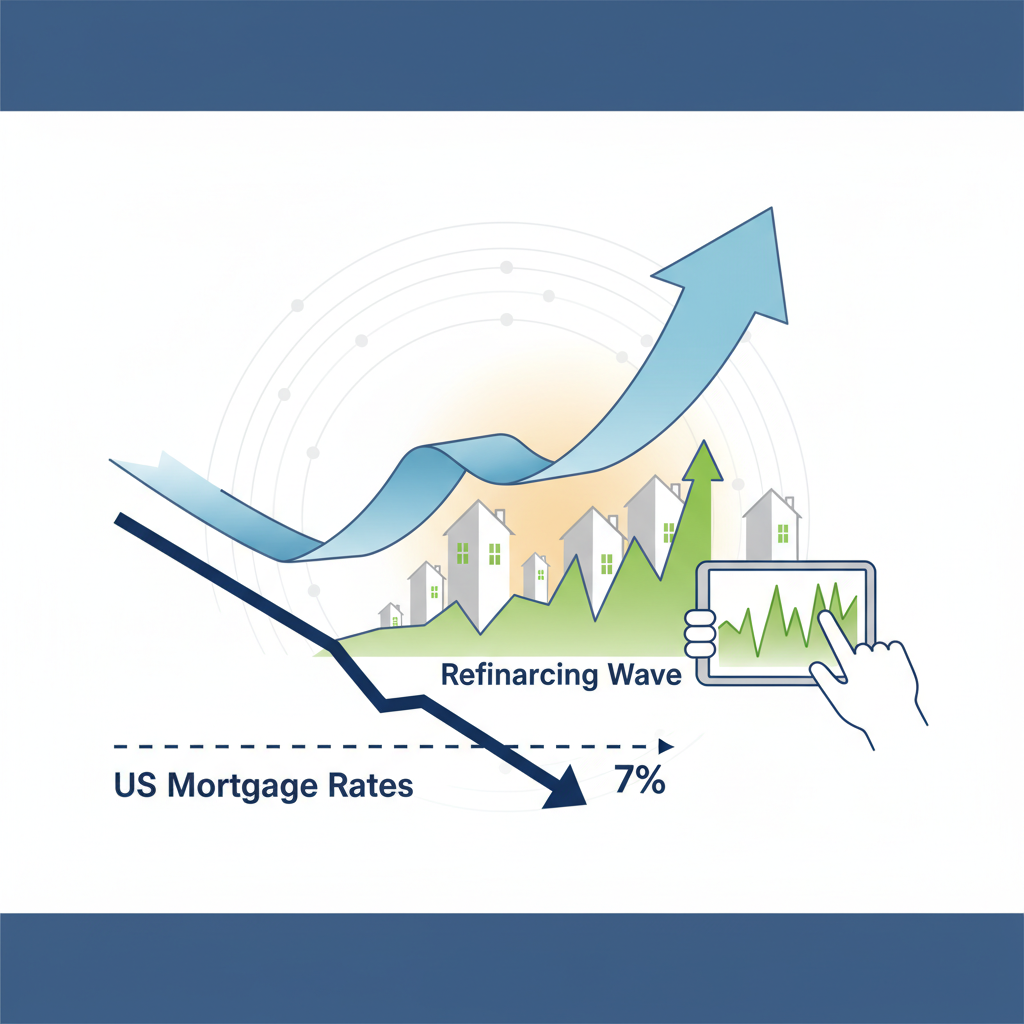

Real Estate, US Mortgage Rates Drop Below 7% Sparking Refinancing Wave

The US housing market is showing signs of renewed activity as mortgage rates dip below the key 7% threshold. This has triggered a surge in refinancing applications and is potentially breathing new life into the real estate sector after a period of relative stagnation.

Mortgage Rates Fall: A Welcome Relief

For months, prospective homebuyers and homeowners have been grappling with stubbornly high US mortgage rates. These rates, influenced by factors like inflation and the Federal Reserve’s monetary policy, had significantly cooled down the housing market. However, recent economic data suggesting a potential slowdown in inflation has led to a decrease in these rates, offering a glimmer of hope.

The drop below 7% is considered a psychologically important level. It’s a rate that makes homeownership more attainable for a broader segment of the population and unlocks opportunities for existing homeowners to refinance their mortgages, potentially saving them thousands of dollars over the life of the loan.

What’s Driving the Rate Decline?

Several factors are contributing to the downward trend in mortgage rates:

- Easing Inflation: The Consumer Price Index (CPI) reports have indicated a moderation in inflation, signaling that the Federal Reserve might slow down its interest rate hikes. This expectation lowers the yield on treasury bonds, which directly impacts mortgage rates.

- Economic Uncertainty: Concerns about a potential economic recession are also playing a role. Investors are seeking the safety of government bonds, further driving down yields and, consequently, mortgage rates.

- Federal Reserve Actions: While the Fed hasn’t explicitly targeted mortgage rates, their overall monetary policy decisions have a significant indirect effect.

Refinancing Applications Surge

The immediate impact of the rate drop is evident in the significant increase in refinancing applications. Homeowners who secured mortgages at higher rates in the past year are now eager to take advantage of the lower rates. A surge in refinancing activity typically benefits the overall economy by freeing up household income and stimulating spending.

“We’re seeing a clear response to the lower rates,” says a senior analyst at a leading mortgage research firm. “Homeowners are running the numbers and realizing that refinancing can significantly reduce their monthly payments and long-term interest costs.”

Who Benefits from Refinancing?

Refinancing is most beneficial for homeowners who:

- Have a good credit score

- Secured their current mortgage when rates were higher

- Plan to stay in their home for several years

However, it’s crucial to consider the costs associated with refinancing, such as appraisal fees and closing costs, to determine if it’s financially worthwhile. A careful cost-benefit analysis is essential before proceeding.

Impact on the Housing Market

Beyond refinancing, the drop in US mortgage rates is expected to have a broader impact on the housing market. Lower rates can stimulate home sales by increasing affordability and encouraging potential buyers to enter the market. This can lead to increased demand, potentially stabilizing or even increasing home prices in some areas. However, the effect might not be uniform across the country, as local market conditions still play a significant role.

Will This Reverse the Housing Slowdown?

While the rate decline is undoubtedly a positive development, it’s unlikely to completely reverse the recent housing slowdown. Several factors continue to influence the market, including:

- Existing Home Inventory: The supply of homes for sale remains relatively low in many areas, which can limit the impact of lower rates on sales volume.

- Economic Outlook: Lingering concerns about the economy and job security can still deter some potential buyers.

- Affordability Challenges: Even with lower rates, home prices remain high in many markets, creating ongoing affordability challenges for first-time homebuyers.

The real estate sector’s recovery will likely be gradual and contingent on sustained low rates and a continued improvement in the overall economic outlook.

Regional Variations in the Real Estate Market

The impact of these changes in US mortgage rates can vary significantly from region to region. Areas with strong job markets and population growth are likely to see a more pronounced rebound in home sales. Conversely, regions with weaker economies or overvalued housing markets might experience a slower recovery.

For example, states in the Sun Belt, which have experienced significant population growth in recent years, may see a quicker response to the rate decline than states in the Northeast or Midwest.

Expert Opinions on the Mortgage Rate Drop

Industry experts are cautiously optimistic about the future of the housing market. They believe that the drop in mortgage rates provides a much-needed boost, but they also caution against expecting a rapid return to the booming conditions of the past few years.

“This is a positive step, but it’s not a magic bullet,” says a real estate economist at a leading university. “We need to see sustained low rates and a stable economy to truly revitalize the housing market.”

Another expert emphasizes the importance of careful financial planning. “Whether you’re a prospective homebuyer or considering refinancing, it’s crucial to do your research and understand the long-term implications. Don’t get caught up in the excitement of lower rates without thoroughly evaluating your individual financial situation.”

Looking Ahead: Future Trends in the Housing Market

The housing market’s future trajectory remains uncertain, but several trends are likely to shape its evolution:

- Continued Rate Volatility: Mortgage rates are likely to remain volatile in the near term, influenced by economic data and Federal Reserve policy decisions.

- Focus on Affordability: Addressing affordability challenges will be a key priority, with potential solutions including increased housing construction and innovative financing options.

- Technological Innovation: Technology will continue to play an increasingly important role in the real estate industry, from online property search to virtual home tours and digital mortgage applications.

Staying informed about these trends will be essential for both homebuyers and sellers in the evolving housing market.

Conclusion

The recent dip in US mortgage rates below 7% has injected a dose of optimism into the housing market, sparking a wave of refinancing applications and potentially stimulating home sales. While challenges remain, this development offers a welcome relief for homeowners and prospective buyers alike. The long-term impact will depend on various economic factors, but for now, the housing market is showing signs of resilience and renewed activity.

Ready to explore your options? If you’re a homeowner considering refinancing, or a prospective buyer looking to enter the market, now is the time to explore your options. Contact a qualified mortgage professional or real estate agent to discuss your individual situation and determine the best course of action. Don’t miss out on potential savings or opportunities in this dynamic market. Take the first step towards your financial goals today!